|

|

| Vorheriges Thema anzeigen :: Nächstes Thema anzeigen |

| Autor |

Nachricht |

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 24.01.2017, 12:11 Titel: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 24.01.2017, 12:11 Titel: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Ich habe ein kleines Testportfolio bei Zlty Melon

http://www.p2p-banking.com/countries/czechrepublic-i-started-a-zlty-melon-test-portfolio/

Bisher läuft es nach Plan. Sind aber auch nur 16 Kredite

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon

Zuletzt bearbeitet von Claus Lehmann am 08.03.2017, 11:00, insgesamt einmal bearbeitet |

|

| Nach oben |

|

|

Elohim

Anmeldedatum: 03.03.2015

Beiträge: 2314

Wohnort: Milky Way

|

Verfasst am: 24.01.2017, 13:48 Titel: Re: Zlty Melon Verfasst am: 24.01.2017, 13:48 Titel: Re: Zlty Melon |

|

|

Mit Häusern besicherte Kredite sind tatsächlich gefühlt sicherer, dafür entsprechend niedrigere Zinssätze.

_________________

Γνῶθι σεαυτόν |

|

| Nach oben |

|

|

StefanAlbert

Anmeldedatum: 02.01.2017

Beiträge: 1322

Wohnort: Schleiz

|

Verfasst am: 24.01.2017, 15:17 Titel: Re: Zlty Melon Verfasst am: 24.01.2017, 15:17 Titel: Re: Zlty Melon |

|

|

| Elohim hat Folgendes geschrieben: | | Mit Häusern besicherte Kredite sind tatsächlich gefühlt sicherer, dafür entsprechend niedrigere Zinssätze. |

Ja, grundsätzlich musst aber noch darauf achten, ob du eine erstrangige oder nachrangige Besicherung hast. Letztere ist unter Umständen auch nichts wert.

_________________

Mein Blog: www.p2p-kredite-vergleich.de |

|

| Nach oben |

|

|

Bandit55555

Anmeldedatum: 30.07.2011

Beiträge: 2533

Wohnort: BW

|

Verfasst am: 24.01.2017, 17:54 Titel: Re: Zlty Melon Verfasst am: 24.01.2017, 17:54 Titel: Re: Zlty Melon |

|

|

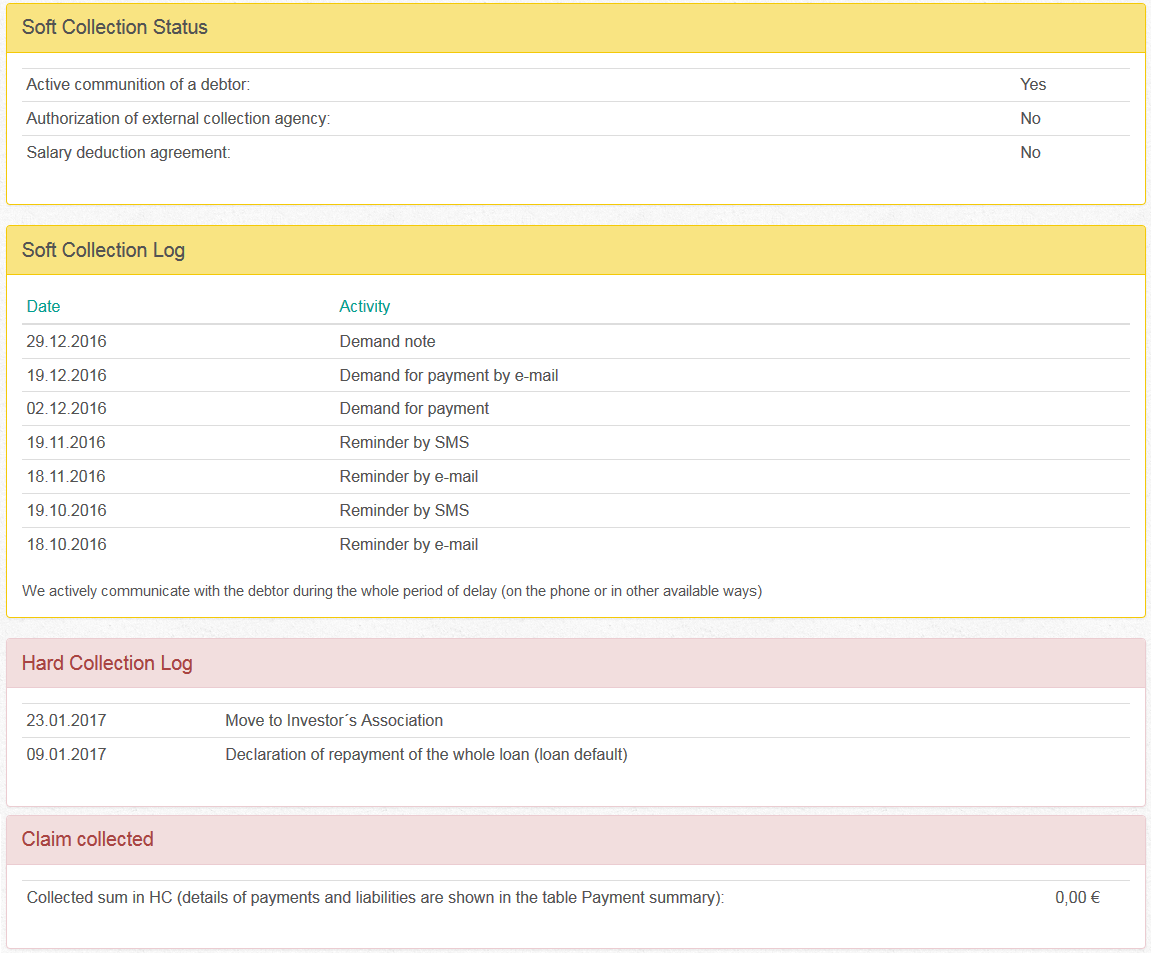

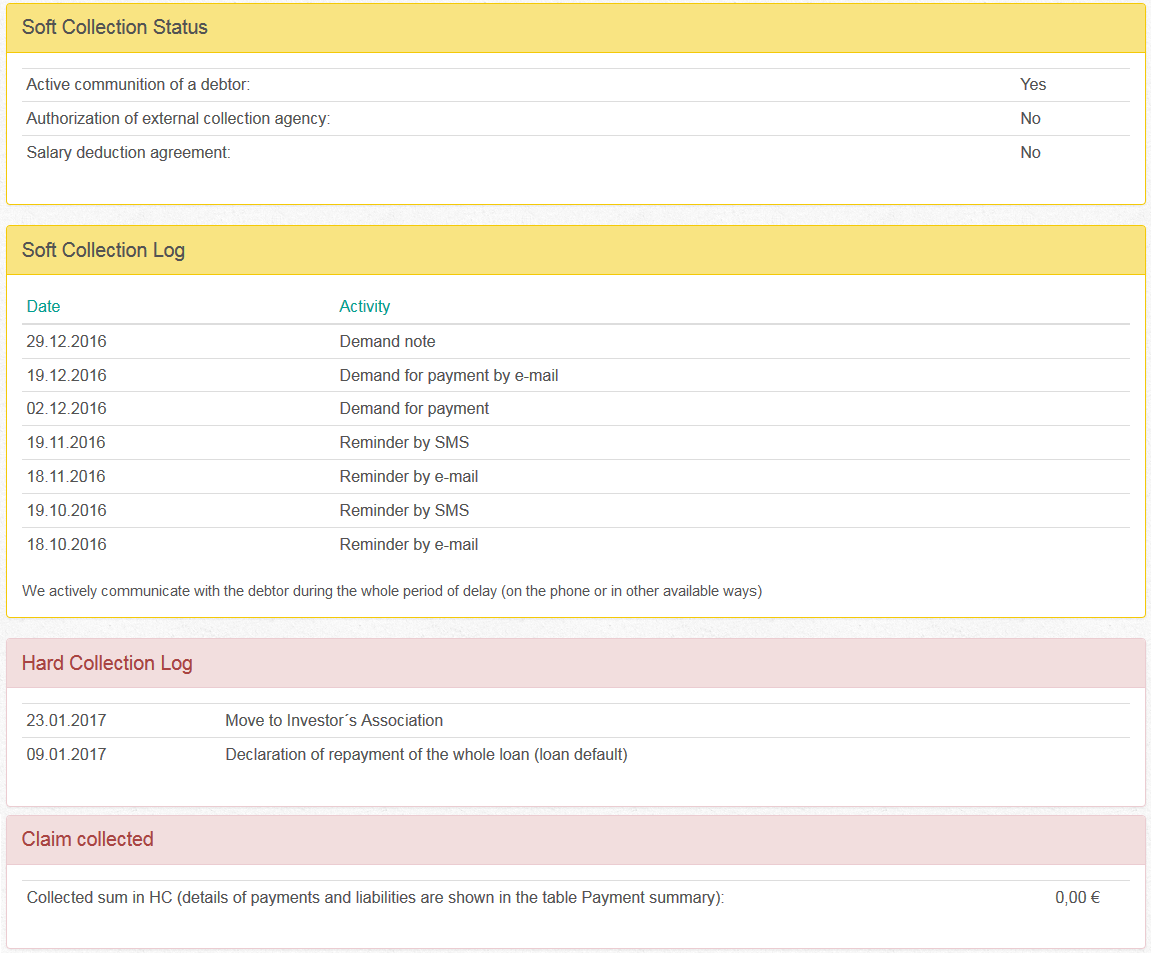

Ich hab seit Juni 2016 ebenfalls ein Testportfolio bei Zlty Melon. Sind nur 11 Kredite mit 22% Durchschnittszins. Ich habe auf Kredite mit höherem Risiko geboten. Also ohne Absicherung. 5 davon zur Zeit in Verzug.

Den ersten Default habe ich bereits.

Theoretisch könnte ich jetzt das Geld unabhängig von Zlty Melon* eintreiben. Aus den FAQ:

| Zitat: | Can i recover the debt to me by a borrower myself?

- Yes. However, Žltý melón has developed a highly effective and full service debt recovery system, including established partnerships with a leading law firm and enforcement agencies that specialise in this area, which it offers to all investors free of charge.

If you nevertheless prefer to deal with the problem of non-repayment independently, we will provide you with all of the necessary legal documents and information to do so, including the identity of the borrower. |

_________________

Meine Rendite: Erhaltene Zinsen:

Finbee: 153.000€,

Omaraha: 118.000€ |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 24.02.2017, 13:42 Titel: Re: Zlty Melon Verfasst am: 24.02.2017, 13:42 Titel: Re: Zlty Melon |

|

|

Bis jetzt laufen die Zinszahlungen meiner 16 Testkredite Bei Zlty Melon* nach Plan. Rückzahlungen stehen ja nicht an, da die Kredite endfällig sind.

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 08.03.2017, 11:01 Titel: Newsletter Verfasst am: 08.03.2017, 11:01 Titel: Newsletter |

|

|

Newsletter

| Zitat: |

Introducing the new Notification Centre

Dear investor,

We are pleased to announce that we have prepared and launched a new notification centre that makes it even easier to keep track of your investments!

You can easily try out the new Notification Centre using the new icon at the top of the page to access your personalised “Feed” of investor information.

Bulletin board

The notification centre provides you with a constantly updating news feed with all of your notifications about your activity on Žltý melón. The information you can find here is the mostly the same as you have previously received via email, but in an easier to digest format that won’t clog up your email inbox! We have also added several new notifications to help you get the most out of using our platform.

Notifications are divided into several different categories and we have included several filters on the left to help you get the information you want as quickly as possible. You can mark individual messages as ‘read’ or mark multiple messages as ‘read’ at once in order to clean up your news feed.

Follow other users and improve your investments

As well as provide a central location for all of your notifications we have also added the ability for you to ‘follow’ other users on Žltý melón in the same way you would on Twitter or other social networks. This innovative feature will allow you keep track of what your friends or some of our top investors are doing in order to help you learn from other people in our community and increase the profits you earn from your investments.

You can follow another investor by searching for their name within the notification centre, or by using the ‘Follow’ button in their investor profile or from within our discussion form. Once you follow an investor information about their investment activity will be displayed in your news feed and if someone follows you they will be updated about your activity.

We are always conscious about protecting your privacy at all times, so if you do not want to share you investment activity with other users it is easy to ‘Block’ any investor that has decided to follow you. However, based on the activity in our forums we think that most of users will welcome the opportunity to communicate more with each other and therefore we have also added the ability for you to post a short message via the notification centre that will be sent to all of your followers.

More control over your email notifications

Obviously we have designed the notification centre based on the feedback we have gotten from you, our users, and your requests to have a better way to get updates about your investments. However, we also realise that for some of you our existing system of email notifications works great and we don’t want to force you to change things if you are already happy!

Therefore, we have introductions more detailed settings which will allow you to control which notifications you receive on your Feed and which you will receive via email. You can easily modify these settings to meet your individual preferences within your Profile after logging in.

We hope you will enjoy these new features and as always, we welcome any feedback on this update to help us improve things even more in the future! |

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

adi4you

Anmeldedatum: 08.02.2016

Beiträge: 58

|

Verfasst am: 25.04.2017, 10:52 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 25.04.2017, 10:52 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

dank Claus seiner neuen Plattform Suche bin ich dabei auf diese Plattform gestoßen.

Zwecks Diversifizierung der ganzen Baltikum Platformen finde ich sie erstmal ganz spannend.

Sicher nicht die hohen Zinsen aber wirkt sehr seriös. Hab mich mal angemeldet aber noch nichts eingezahlt.

Aktuell nur 4 Kredite, kann das sein?

Unter der Datenbanksuche ist sie auch bei "Buyback (oder ähnlich)" aufgeführt. Darüber konnte ich allerdings noch nichts finden. Wie ist das gemeint?

Da es hier relativ wenige Posts gibt. Wie sind so die bisherigen Erfahrungen?

edit:

ok buyback habe ich jetzt gefunden "CashFree". Es gibt nur keine?  |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 25.04.2017, 14:07 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 25.04.2017, 14:07 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

genau Buyback haben die Cashfree Kredite. Es gibt immer mal wieder welche. Muss man drauf warten.

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

buttchopf23

Anmeldedatum: 04.04.2016

Beiträge: 2935

|

Verfasst am: 10.05.2017, 16:34 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 10.05.2017, 16:34 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

| Zitat: | Dear investor,

We are excited to announce the introduction of our new Quick Loan product on Žltý melón.

What is it?

The amount of the loan is lower than for standard loans - from 100 to 500 EUR – as it is designed to provide a cheaper alternative to people currently trapped in a cycle of borrowing with high cost lenders.

Borrowers pay only the interest on the loan, which is fixed at an affordable rate, and repayment is due in full 30 days later. However, the borrower has the option of extending the loan for up to 6 months and repaying in a series of smaller, more manageable, regular monthly installments .

Quick Loans are not only fair, but also a great deal for both borrowers and investors, The structure of the loan means it is possible to earn high returns without having funds locked up in long-term investments.

The juicy details!

The loan will be classified in the "HR" rating class, due to the type of customer and is therefore riskier, but also more profitable, than investing in our standard loans. Also, as these loans are for smaller amounts, you can only invest a maximum of 50 EUR in each of these loans. This helps ensure your risk is limited through increased diversification.

If loans are extended, the repayment dates are based on the date the loan was taken out, rather than being paid on the 15th like our standard loans. Similarly, as investment in these loans is initially set for 6 months, to ensure borrowers are able to extend their repayments if necessary, the earnings on loans that are repaid earlier is proportionally higher than for standard loans.

All of these loans will be assigned the “HR“ credit rating and the recommended interest rate will be fixed at 26.4% p.a., making them more risky and more profitable than investments in standard loans. Also, as these loans are for smaller amounts, you can invest a maximum of 50 EUR in each of these loans. This helps ensure your risk is limited through increased diversification.

Due to the short duration of auctions for Quick Loans, it is highly recommended that you use the Auto-invest tool to make your investments for you. To do this, you need to set the minimum loan amount at € 100 in Autoinvest and the minimum amount for a single investment at € 50 or less.

Loans that are responsible and human

We decided to introduce this type of loan to help people that currently rely on short-term loans get a better rate, and avoid getting trapped in a cycle of debt with the current high cost lenders.

Many of our loan applicants are regularly repaying their existing short term loans each month, at very high costs, but we have not yet been able to offer them a loan that meets their needs.

Our new loan product is both fair and affordable, and is very different than the loans offer by other high cost lenders that keep people trapped in a cycle of borrowing.

People can now get the money they need today, as well as a chance to build up their credit history with us for the future. This will enable them to qualify for a standard loan with us, at an even better rate, which can be used to help them pay of thier existing debts in a much more affordable way.

Availability

Our new Quick loan product will be listed on our platform in May and available for you to invest in immediately. We believe that you will both agree with our social purpose for launching this new product, as well as benefit from this profitiable investment opportunity.

Sincerely yours,

Žltý melón |

_________________

Mein p2p Blog: www.p2phero.blog |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 11.09.2017, 11:09 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 11.09.2017, 11:09 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Der Zinssatz für die cashfree Kredite ist von 5,9% auf 4,9% gesunken.

Hab es in der vergleichs-Datenbank aktualisiert

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 07.11.2017, 13:26 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 07.11.2017, 13:26 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Newsletter:

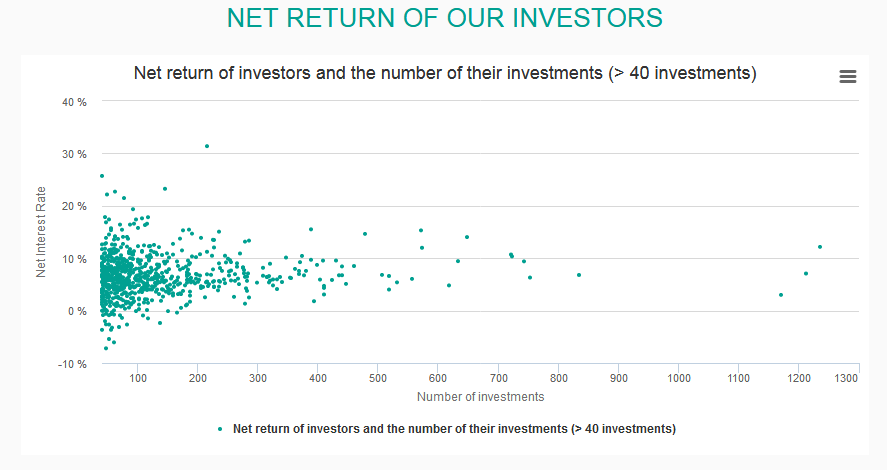

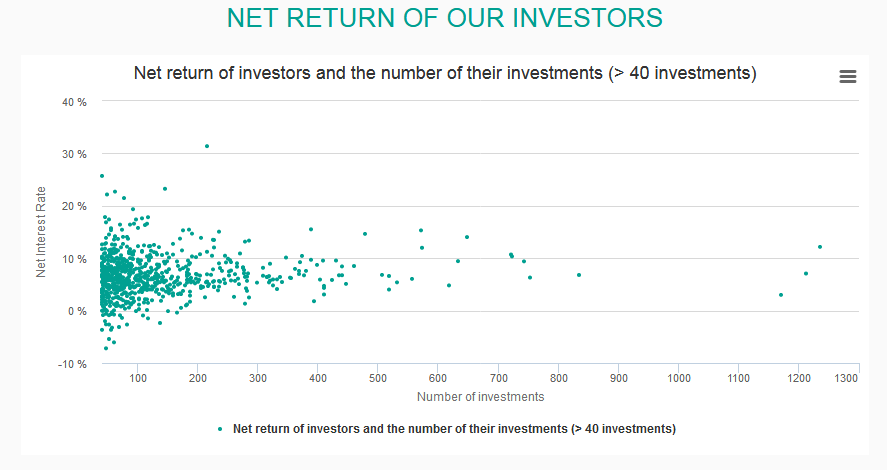

| Zitat: | We are excited to announce some new features on Žltý melón to help you monitor your earnings and investment portfolio on our platform!

1) We have added a new Net Investment Returns statistic to the Investor Terminal to help you easily monitor the profitability of your investment portfolio.

2) There is a new graph available on the Investor Terminal and our Statistic page, that shows the current Net Investment Returns for all of our investors that have funded at least 40 different loans on our platform.

How is the Net Investment Return statistic calculated?

The Net Interest Rate statistic for your investment portfolio provides you with a clear indication of what you can actually expect to earn on our platform, taking into account your investment fees, the current mix of loans in your portfolio as well as the expected losses from any loan defaults.

We calculate this statistic using the scheduled monthly installment payments for your current loan portfolio, which includes the repayments of loan principal, interest charges, penalty fees minus our administration fees. We then adjust this amount to take into account the expected losses resulting from any loan defaults as well as expected income you will earn from the legal enforcement and collection of those debts that we undertake on your behalf. These adjustments are based on the historical performance of our loan portfolio and the recovery rates for loan defaults on our platform.

Finally, we take the adjusted monthly installment amount for your investment portfolio and weight it based on the average maturity dates and investment amounts for the individual loans in your portfolio, to provide you with the Net Interest Rate for your investment portfolio on Žltý melón.

This statistic not only allows us to provide you with a simple and highly accurate statistical representation of the current 'real-time' performance of your investment portfolio, but we also use this same methodology to provide statistics about the performance of our entire loan portfolio and the average returns earned by all of our investors.

It also allows us to provide you with a Net Investment Return statistic, which gives you a simple yet highly accurate projection of the future earnings from your investment portfolio on an annual (p.a.) basis, while also fully taking into account the diverse mix of maturity dates and interest rates for the individual loans you have invested in on our platform.

Your Net Investment Return statistic is calculated at the end of each calendar month and therefore reflects the most recent data about your investment portfolio at the end of the previous month. |

EDIT:

Hier die Grafik dazu

So sieht das aus in meinem Account

Wird ungefähr stimmen, da alle meine Kredite zu 5,9% Zinssatz sind (keine Ausfälle, keine Verzüge).

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 14.12.2017, 17:26 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 14.12.2017, 17:26 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Mehrere meiner langlaufenden Immobilienkredite wurden heute vorzeitig abbezahlt.

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 20.12.2017, 16:30 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 20.12.2017, 16:30 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

| Zitat: |

Žltý melón introduces Secondary Market Version 2.0

Dear investor,

Like elves at the North Pole, the team here at Žltý melón has been working hard to finalise a ‘Christmas Surprise’ for our community that we are very excited about.

Now, the day is here and we can rip off the wrapping paper and officially announce the launch of our new Secondary Market v2.0. - now with 2 times as much fruity goodness!

We introduced our Secondary Market in June 2016 and we will always be proud of how well it has gone – in a very modest way of course). From what you tell us it is a popular feature and it has grown quickly.

Some fun facts:

Efficient: 4,323 investments have been listed on the secondary market and 2,940 (68.0 %) of them have been sold successfully

Competitive: 64.8 % were sold above the seller’s asking price

Fair: 14.2 % were sold for 100% of the remaining loan principal

Profitable: 22.8% were sold at a premium to the remaining principal

King of the Market: Panther08 bought the most investments (226)

So, our Secondary Market is maybe not very fancy, but it clearly does what it says on the melon tin. It provides people with an easy way to sell their existing investments to our great community and get access to their cash when they need it.

But Žltý melón at we are never happy to settle for just fit and functional, so we took all the feedback we got from our investors into a brainstorming meeting and figured out how to make our Secondary market fresh and fruity instead!

Or, in boring p2p language, we have made it more efficient, effective and profitable for our investors.

Whats new in the Secondary Market v2.0

We have put in place the maximum offer length and the price limits, respectively. time limit for re-bidding.

A faster, more competitive market

Maximum offer time is now 14 days.

If the investment is not sold after 14 days, the seller has two options:

- Restart the auction immediately but at a reduced asking price; OR

- Wait 30+ days before listing the loan sale again, but at any price

Minimum price reduction levels are based on loan repayment status

- At least 0.1 % lower for ‘good loans’,

- At least 1.0 % lower for loans with 30+ days late payment

- At least 5.0 % lower for loans in default / legal collections)

If a loan payment is made during an auction, the 14 day period resets

- The new auction can be listed without any price restrictions

If an auction is cancelled early by the seller, it counts as ‘not sold’

A separate, more feature-filled market.

With all the new features we are introducing to the Secondary Market v2.0, we felt that it needed more space to grow and be awesome by itself.

This means:

A new separate page for the Secondary Market, rather than it being a tab on the normal auction listings page

- Quick access via the menu bar and new Investor Terminal section

Separate tabs for different types of loan auctions on the Secondary Market, based on the loan repayment status

- Good Repayments (0-30 days late repayment)

- Late Repayments (More than 30 days)

- Defaults / Collections (Legal enforcement process for repayments)

Filters to help you easily find the loan auctions you want to buy

Export features to create lists of loan auctions as .csv files

Who, what, where and why

We have introduced an exciting new set of features and changes for our Secondary Market 2.0, which are based directly on the feedback sent to us by our investors (thank you!).

These changes will not only make the Secondary Market easier to use, but will also help make it function more efficiently and competitively, so that loans can be bought and sold in a way that will benefit everyone in our community!

With fruity and kind regards |

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

gugulete

Anmeldedatum: 22.04.2018

Beiträge: 15

|

Verfasst am: 23.05.2018, 23:10 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 23.05.2018, 23:10 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Hello sir,

How's the investment in Zlty Melon?

I would like to invest in Cash Free Loans, at the moment offering a 5.4% interest, but I understand that there is a bonus that can reach up to 2%, in this way the total interest rate is 7.4%, which is not bad. There are several types of Cash Free: Hypo and BYVANIE 4.9% (backed by a property)

But these Cash Free loans are like Buy Back Guarantee at Mintos? What happens if the debtor does not pay his loan? |

|

| Nach oben |

|

|

Claus Lehmann

Site Admin

Anmeldedatum: 31.08.2007

Beiträge: 18172

|

Verfasst am: 05.11.2019, 10:19 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) Verfasst am: 05.11.2019, 10:19 Titel: Re: Zlty Melon Erfahrungen (Tschechien und Slowakei) |

|

|

Zlty Melon scheint das Modell zu ändern/zu erweitern und steigt auch in das Geschäft mit den Darlehensanbahnern ein. Als Darlehensanbahner wird Redlee genannt

| Zitat: |

Invest your money for stable 7.9% p.a. with the buyback guarantee of professional credit providers.

Dear investor,

We would like to inform you about news on Žltý melón.

Žltý melón in cooperation with the partner, REDLEE company, brings to the clients a unique investment product, investing in loans of major world lenders. All investments are guaranteed by established lenders.

What are advatages of investining in this product

Buyback Guarantee - redemption of principal and interest

With all loans you gain a buyback guarantee of repayment of principal and interest in case of repayment problems. REDLEE works only with prominent professional lenders, who at the same time retain their share and commitment in all loans.

No investment management fees

Unlike at any other product, you do not pay investment management fees for this product.

Speed of placing money

You invest in loans that have already been drawn. Therefore, your money is not blocked in the offers, where the debtors are awaiting the signing of contracts and there is no risk that the contracts will not be signed.

High diversification and availability of money

As these are primarily short-term and low-borrowing loans, you have the opportunity to achieve a high diversification of your investment and your money is only blocked for a short time. Of course, you can also sell these investments on the Secondary market.

How does it work?

If you have an active investor account on Žltý Melón, you can easily invest directly into these loans, in the Auctions section of the Partners Loans tab. This gives you one-click access to higher, guaranteed returns.

The minimum investment per loan is 1 EUR. The maximum limit for your total investment (the amount of your investment portfolio) is not limited.

As this product is working under different legal framework for the realization of the investment, your first investment requires confirmation of contract. You are investing in loans that have already been granted to debtors, therefor you lend your money to a professional lender for the sole purpose of refinancing the loan.

TIP: If you have set up Autoinvest and selected your own portfolio, be sure to adjust it and allow investment in this type of loans, too.

Investment security

This product not only allows you to achieve above-standard value for money, but also provides high security and guarantees for all investments. The main elements of investment protection include:

Guarantee of repurchase of receivables

Should the borrower fail to repay his loan properly, the loan provider guarantees the repayment of the entire claim from the investor. This will be done within a maximum of 60 days of any delay. The investor gets outstanding principal and also unpaid interest.

Engagement of "skin in the game" providers

The professional lenders we cooperate with do not sell their entire loan to investors, but retain a minimum stake of 10%. Along with the buyback guarantee, providers are even more motivated to pay additional attention to loan management, risk management and borrowing.

Only proven providers

REDLEE works only with trusted and well established professional lenders who have long time experience and significant market share. It monitors their history, size, financial parameters, quality and risk management standards, credit portfolio quality and performance, and many other parameters that need to guarantee effective collaboration.

You can learn more about the product on the page:www.zltymelon.com/partnerske-uvery |

_________________

Meine Investments (aktualisiert 12/24):

Laufend: Bondora*, Estateguru*, Indemo*, Inrento*, Mintos*, Crowdestate* (Rest), October* (Rest), Linked Finance* (Rest), Plenti (Rest), Ventus Energy*, Seedrs*, Crowdcube, Housers* (Rest),

Beendet: Smava, Auxmoney, MyC4, Zidisha, Crosslend, Lendico, Omarahee, Lendy, Ablrate, Bondmason, Finbee*, Assetz Capital, Bulkestate, Fellow Finance, Investly*, Iuvo*, Landex, Lendermarket*, Lenndy, Moneything,

Neofinance*, Reinvest24, Robocash*, Viainvest*, Viventor, Zlty Melon |

|

| Nach oben |

|

|

|

|

Du kannst keine Beiträge in dieses Forum schreiben.

Du kannst auf Beiträge in diesem Forum nicht antworten.

Du kannst deine Beiträge in diesem Forum nicht bearbeiten.

Du kannst deine Beiträge in diesem Forum nicht löschen.

Du kannst an Umfragen in diesem Forum nicht mitmachen.

|

phpBB SEO URLs V2

*Anzeige / Affiliate Link

Powered by phpBB © 2001, 2005 phpBB Group

Deutsche Übersetzung von phpBB.de

Vereitelte Spamregistrierungen: 199087

Impressum & Datenschutz |